Investors are always seeking tools to help them make informed decisions in the financial markets. One such tool is the ETF heatmap available on TradingView.

This tool offers a comprehensive overview of key ETF sectors, helping investors visualize market trends and emerging opportunities. By highlighting the performance of different sectors, the ETF heatmap provides a clear, data-driven approach to sector rotation strategies.

In this article, we’ll explore the key ETF sectors to watch in 2024 using TradingView’s ETF heatmap and how you can leverage this tool for better investment decisions.

Introduction to ETF Heatmaps

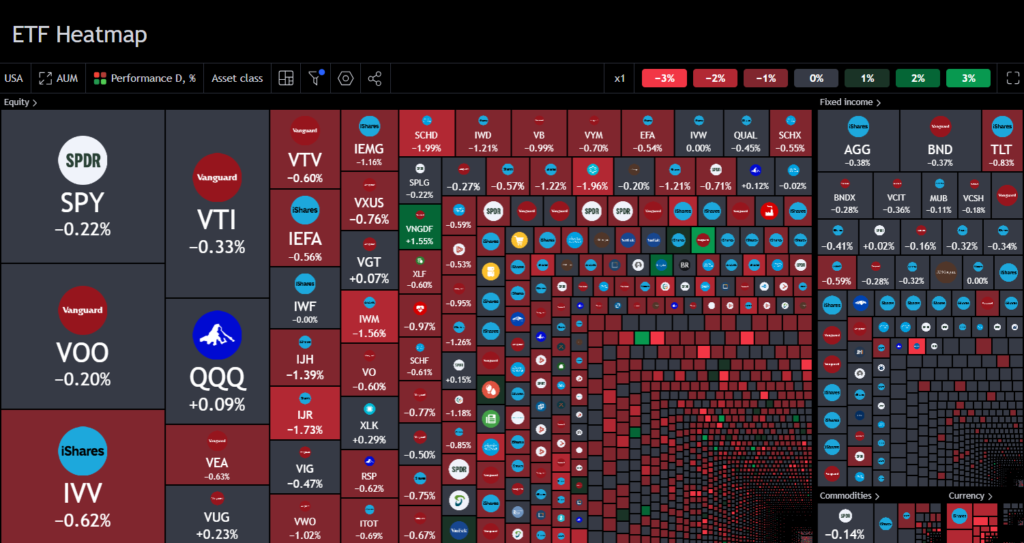

ETF heatmaps offer a visual representation of how different sectors are performing in real-time. TradingView’s ETF heatmap provides an interactive tool where investors can track sector performance by color-coding ETFs based on their returns. The tool allows you to quickly identify top-performing sectors and those that may be underperforming, giving you an edge in making strategic investment decisions.

The heatmap aggregates data from a wide array of ETFs, covering various sectors, including technology, financials, healthcare, commodities, and more. By using the ETF heatmap, investors can compare different sectors and identify which ones are heating up, making it easier to spot potential buying opportunities.

Also Read: Identifying Top ETFs with TradingView ETF Heatmap

Top ETF Sectors to Watch in 2024

With the global economy showing signs of recovery, certain sectors are expected to outperform others in 2024. Using TradingView’s ETF heatmap, here are the key sectors to focus on for potential growth:

a. Technology

Technology continues to dominate the investment landscape. The technology sector has been resilient, with ETFs like the MSCI ACWI Semiconductors & Semiconductor Equipment ESG Filtered showing impressive returns of over 49.97% in the past year. This sector includes companies involved in cloud computing, cybersecurity, artificial intelligence, and semiconductor production, all of which are critical to the modern economy.

Tech-focused ETFs such as S&P 500 Capped 35/20 Information Technology and S&P Select Sector Capped 20% Technology have consistently delivered strong performance, making technology a key sector to watch in 2024. These ETFs provide exposure to tech giants like Apple, Microsoft, and Google, which continue to lead in innovation and revenue growth.

b. Financials

Financial services ETFs, such as SPDR S&P Bank ETF (KBE) and iShares MSCI Europe Financials ETF (EUFN), are worth considering.

The financial sector is poised for growth as rising interest rates and increased consumer spending boost banks’ profitability. The heatmap shows financial ETFs gaining momentum as banks, insurance companies, and financial institutions benefit from the evolving macroeconomic environment.

c. Commodities

Commodities, particularly precious metals like gold and silver, have consistently performed well during periods of economic uncertainty.

The Solactive Global Pure Gold Miners and DAXglobal® Gold Miners ETFs are prime examples of how the gold mining sector has surged, with gains of 39.76% and 39.22%, respectively.

Commodities offer diversification, especially in inflationary environments where traditional assets may underperform. By tracking these ETFs on the heatmap, investors can spot trends in commodities that may offer high returns, particularly if economic conditions worsen.

d. Utilities

The utilities sector, known for its stability, is another area to monitor. With the world moving towards renewable energy, utilities ETFs, such as the S&P Utilities Select Sector, offer a balanced mix of traditional and green energy companies.

Utilities have outperformed in recent months, and with increased demand for renewable energy solutions, this sector is expected to grow further in 2024.

Utilities ETFs benefit from steady cash flows, making them ideal for investors looking for dividend income and lower risk. The heatmap can help pinpoint specific utility ETFs that are trending upwards, enabling a defensive yet growth-oriented approach to investing.

Also Read: Best Ways to Use ETF Heatmap For Portfolio Diversification

Leveraging TradingView’s ETF Heatmap

TradingView’s ETF heatmap is an invaluable tool for both novice and experienced investors. It offers several key benefits:

- Visual Insights: The color-coded display allows investors to easily spot top-performing and lagging sectors. For example, green indicates sectors with positive momentum, while red highlights sectors that are underperforming.

- Sector Rotation: As markets evolve, some sectors outperform while others lag. Using the heatmap, you can quickly identify sectors that are heating up and rotate your investments accordingly.

- Customizable Data: Investors can customize the heatmap to focus on specific asset classes or geographies. Whether you’re interested in US sectors or want global exposure, the heatmap provides tailored insights that match your investment preferences.

- Real-Time Updates: The ETF heatmap on TradingView provides real-time updates, allowing you to monitor market changes throughout the trading day. This feature helps investors make timely decisions based on the latest data.

Diversification and Risk Management

One of the primary advantages of using the ETF heatmap is that it enables effective diversification. According to Trackinsight, personal investors should aim to hold 5 to 10 ETFs across different asset classes and geographies. The heatmap allows you to identify sectors that are negatively correlated, helping to spread risk across your portfolio.

For instance, while technology ETFs may offer high growth, including utilities or commodity ETFs in your portfolio can provide stability during market downturns. The ETF heatmap simplifies this process by giving a clear picture of sector performance and helping you adjust your portfolio accordingly.

Also Read: How Can ETF Heatmap Help You Visualize ETF Market Trends?

Conclusion

As markets become more dynamic, the ability to track sector performance is crucial. TradingView’s ETF heatmap is a powerful tool that provides investors with real-time insights into sector trends, helping them identify the best ETF sectors to invest in. Whether you’re focused on high-growth sectors like technology or prefer the stability of utilities and commodities, the ETF heatmap can help you make well-informed decisions.

By keeping an eye on key ETF sectors such as technology, financials, and commodities, you can position your portfolio for success in 2024. Utilize the ETF heatmap to its full potential, and ensure that your investment strategy remains adaptable in the ever-changing market landscape.